401k to roth ira rollover calculator

Please verify with your plan administrator that your distribution is eligible for a rolloverconversion. A Solo 401k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan.

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

. Heres how to choose between a Roth IRA and a Traditional IRA Jump ahead for more tips on choosing between an IRA and a 401k. Decide if you want to manage the investments in your IRA or have us do it for you. Learn about Roth IRA conversion.

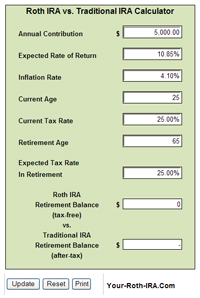

Roth IRAs have income limits. Traditional IRA comparison page to see what option might be right for you. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement.

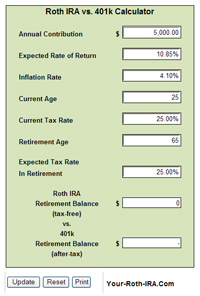

Roll over your 401k to a Roth IRA If youre transitioning to a new job or heading into retirement rolling over your 401k to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free. Converting to a Roth IRA may ultimately help you save money on income taxes. You can use our IRA Contribution Calculator or our Roth vs.

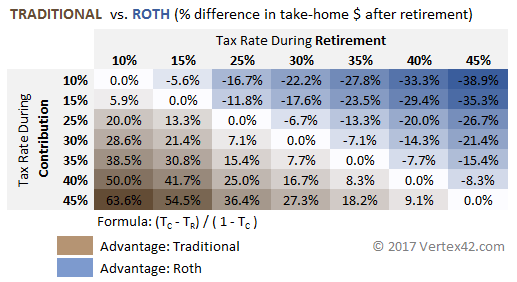

Related Retirement Calculator Investment Calculator Annuity Payout Calculator. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be.

Pros You can roll Roth 401k contributions and earnings directly into a Roth IRA tax-free. As your income increases the amount you can contribute gradually decreases to zero. You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401k into a Roth IRA.

Heres more on the pros and cons of the IRA vs.

Roth Ira Calculators

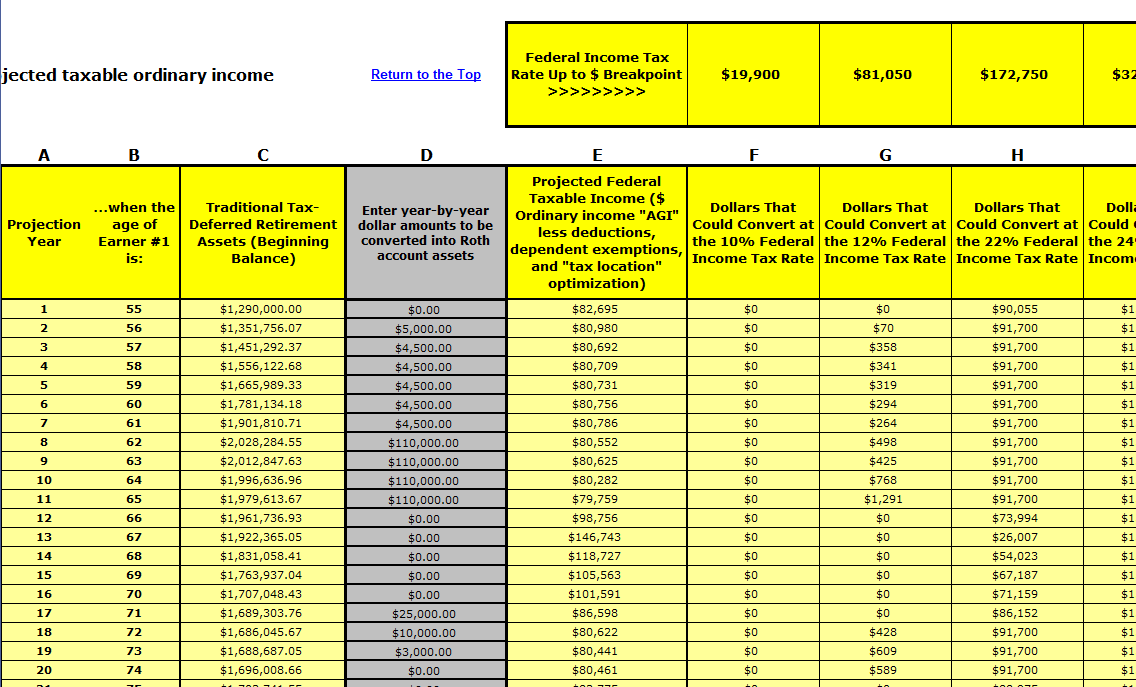

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

401k Rollover Calculator To Roth Traditional Sep Or Simple Ira

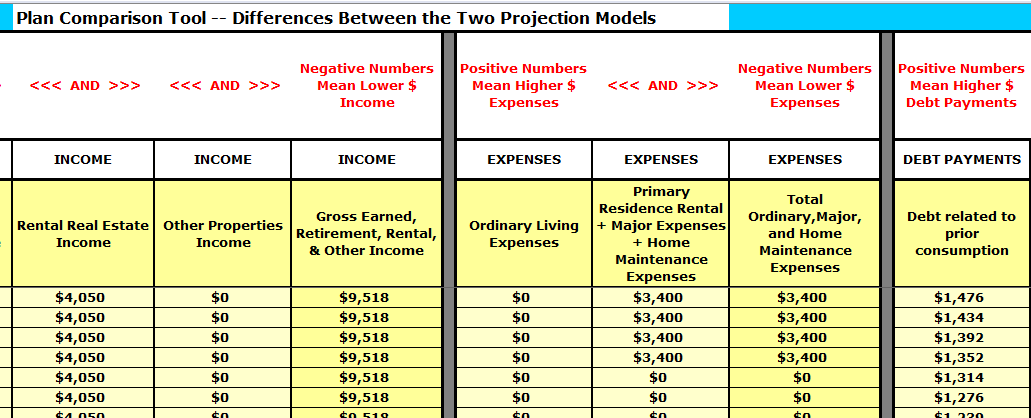

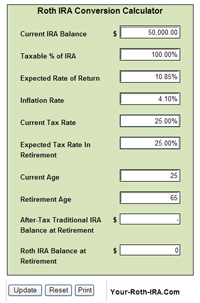

Roth Ira Conversion Tax Calculator Software

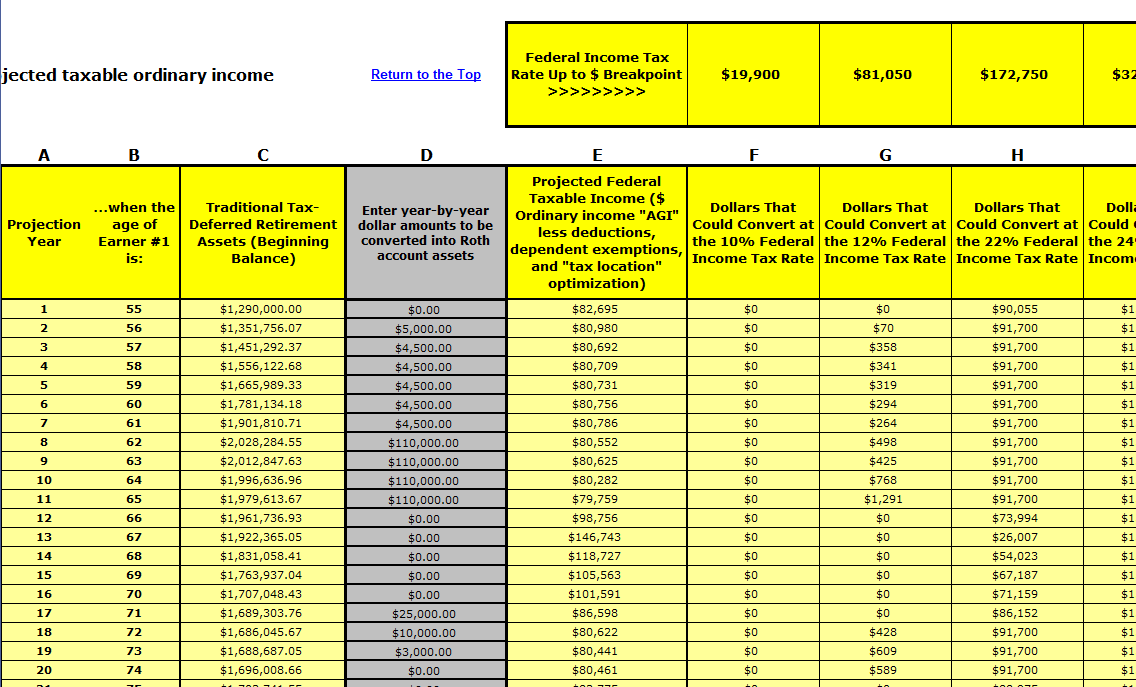

Roth Ira Conversion Calculator Excel

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Traditional Vs Roth Ira Calculator

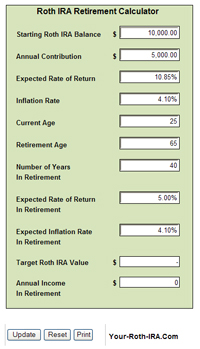

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Roth Ira Contribution

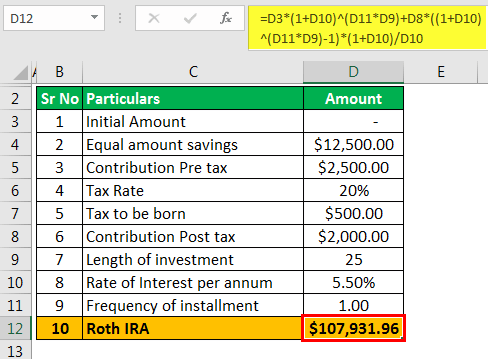

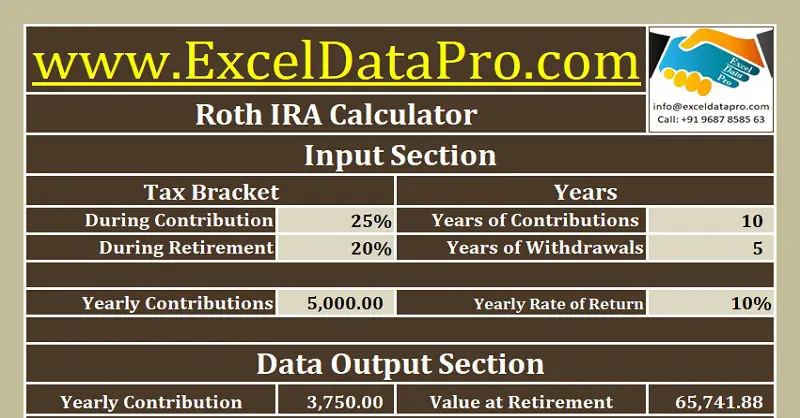

Download Roth Ira Calculator Excel Template Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculators

Roth Ira Calculators